Kinerja Ekonomi Indonesia Q2 2024

Sep 10, 2024

Kinerja Ekonomi Indonesia Q2 2024 Kuartal kedua tahun 2024 menampilkan gambaran yang beragam,

Vietnam’s digital generation

Vietnam’s digital generation report. In May 2021, Cimigo conducted a nationwide (urban and rural) survey amongst the Vietnam digital generation with 1,500 Vietnamese aged 16-29 years old who have grown up in a digital-savvy world.

4 minute read.

The results explore the characteristics of Vietnam’s young generation, aged 16-29 years old and who comprise 21% of Vietnam’s population with 20,225,046 people.

Born and raised in the explosive era of the Internet, the 16-29 age group has different characteristics compared to previous generations. Cimigo has labeled this age group of people as the digital generation in Vietnam.

With the development trend of the internet and the utilities that come with it, they tend to be more familiar with mobile phones, smartphones and online interactive platforms. This young demographic can be broken down into 3 subgroups:

The Vietnamese digital generation has grown up experiencing the rise of the internet and e-commerce activities. They are the leading generational group in maximising the conveniences that the internet and smartphones provide. As a generation, they are more globally aware and sensitive to social issues and their own desires for economic progress. Understanding the Vietnamese digital generation can help businesses leverage their desires and resonate more strongly in communications. The Vietnamese digital generation will be the driving force behind the rapid development of the Vietnamese economy and society in the decade ahead.

Download Vietnam’s Digital Generation report here

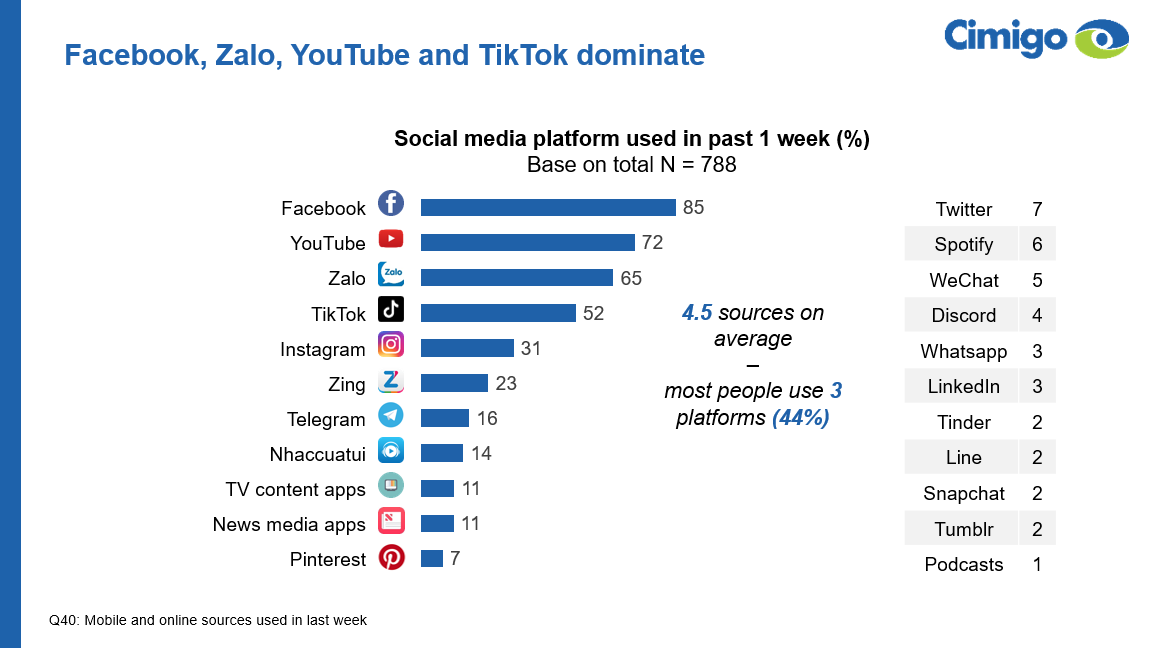

The attitudes and desires between the urban and rural digital generation in Vietnam are remarkedly similar. The disparity of the digital lives of urban and rural Vietnamese in the digital generation in Vietnam is far less than the reader may expect. Leading social platforms are similar across urban and rural Vietnam, with nearly identical penetration rates for the top platforms. Whilst urban Vietnamese use 4.6 platforms on average, rural Vietnamese use 4.5 on average.

The prevalence of online gaming in the past one month in urban areas is 54% and in rural areas is 41%, online shopping prevalence in the past one month in urban areas is 54% and in rural areas is 43%, cashless payments prevalence for online shopping is Vietnam in urban areas is 42% and in rural areas is 31%. E-wallet use in the past one month for any purpose, including online shopping, in urban areas, is 67% and in rural areas is 66% in the past one month.

The top channels for news are Facebook (85%), YouTube (49%), Zalo (36%) and TikTok (30%), rural residents are very slightly more reliant on these platforms than urban residents. Vietnam’s digital generation in rural Vietnam is slightly less likely to use news and TV apps for news than their urban counterparts.

Vietnam’s digital society and media is bringing the worldview of this digital generation across urban and rural society even closer.

The Vietnamese digital generation is optimistic about starting a family of their own and owning a home. Small families living independently of their parents are desired more, but traditional mores in connecting over dinner with the extended family remain appreciated.

Career, income, family and educational background are the main factors that shape the digital generation’s perspectives. Perceived gender roles are more equitable in achieving financial independence.

Download Vietnam’s Digital Generation report here

Social media networks in particular shape their worldview. The digital generation seeks financial independence, career progression and to be loved by their family.

70% aspire to become a leader at work and to start their own business. Women show more anxiety than men, especially towards social division and income stability.

The Vietnamese digital generation has a heightened interest in social issues. The Vietnamese digital generation pays attention to pollution, environmental protection and food safety. Females are especially interested in gender equality whilst the 25-29 age group is acutely interested in Vietnam’s sovereignty over the East Sea.

Two-thirds of the digital generation are interested in positive social impact. 6 in 10 want to have a positive impact on the lives of those less fortunate and 8 in 10 wish to contribute positively to the development of Vietnamese society.

Download Vietnam’s Digital Generation report here

Entertainment is an integral part of life for the digital generation in Vietnam. The rise of smartphones offers many development opportunities for game developers to serve the needs of more than half of the Vietnamese digital generation every week.

Smartphones (49%) and computers (30%) are two of the most used devices for the digital community to enjoy games, while multiplayer online battle arena (MOBA), shooting games and battle royale are most popular among the Vietnamese digital generation today.

47% of the digital generation in Vietnam shop online, with an average frequency of 3.5 times per month. This prevalence rate is higher among women (55%) and urban areas (54%). The top 3 popular online shopping categories in Vietnam are fashion (57%), cosmetics and personal care (24%) and electronic accessories (21%). Shopee (69%), Facebook (32%), Lazada (32%) and Tiki (16%) are the most popular e-commerce platforms in Vietnam amongst the Vietnamese digital generation.

Download Vietnam’s Digital Generation report here

64% of online shoppers in Vietnam use cash-on-delivery (COD). 22% of online shoppers in Vietnam use bank transfers and 13% use e-wallets. The e-wallet Momo has a 51% market share of e-wallets used for online shopping in Vietnam, followed by Shopee pay (15%) and ZaloPay (11%). The remaining market share is evenly distributed among more than 40 other providers such as Moca/GrabPay, BankPlus, ViettelPay, etc.

E-wallet use in the past one month for any purpose, including online shopping, is 66% amongst Vietnam’s digital generation nationally.

Facebook (85%), YouTube (72%) and Zalo (65%) are the 3 most used social platforms in Vietnam. TikTok (52%) is used by more than half of the digital generation in Vietnam. On average, each individual uses 4-5 social networking platforms as a means for entertainment, to connect with friends and a place to express themselves.

Download Vietnam’s Digital Generation report here

End.

Kinerja Ekonomi Indonesia Q2 2024

Sep 10, 2024

Kinerja Ekonomi Indonesia Q2 2024 Kuartal kedua tahun 2024 menampilkan gambaran yang beragam,

Survei keuangan digital Indonesia: aplikasi e-wallet dan fitur paylater-nya

Aug 11, 2024

Aplikasi e-wallet sangat populer di Indonesia Digitalisasi adalah aspek yang tak terhindarkan dari

Produsen Mobil Beraksi di GIIAS 2024, Melawan Penurunan Industri di Indonesia

Jul 20, 2024

Industri otomotif Indonesia menghadapi penurunan di tengah meningkatnya persaingan Riset pasar

Hy Vu - Head of Research Department

Steve Kretschmer - Executive Director

Joe Nelson - New Zealand Consulate General

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Ha Dinh - Project Lead

Matt Thwaites - Commercial Director

Joyce - Pricing Manager

Dr. Jean-Marcel Guillon - Chief Executive Officer

Anya Nipper - Project Coordination Director

Janine Katzberg - Projects Director

Rick Reid - Creative Director

Private English Language Schools - Chief Executive Officer

Chad Ovel - Partner

Thanyachat Auttanukune - Board of Management

Thuy Le - Consumer Insight Manager

Kelly Vo - Founder & Host

Hamish Glendinning - Business Lead

Aashish Kapoor - Head of Marketing

Richard Willis - Director

Thu Phung - CTI Manager

Tania Desela - Senior Product Manager

Dennis Kurnia - Head of Consumer Insights

Aimee Shear - Senior Research Executive

Louise Knox - Consumer Technical Insights

Geert Heestermans - Marketing Director

Linda Yeoh - CMI Manager

Tim market research Cimigo di Indonesia dengan senang hati membantu Anda membuat keputusan yang lebih tepat.

Cimigo menyediakan solusi riset pasar di Indonesia yang akan membantu Anda membuat pilihan yang lebih baik.

Cimigo menyediakan tren pemasaran konsumen Indonesia dan riset pasar pada sektor pasar dan segmen pelanggan di Indonesia.

Cimigo menyediakan laporan riset pasar pada sektor pasar dan segmen pelanggan di Indonesia.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Please enter the information for free download.

The report will be sent to your email.