Marketing tactics

Concept writing guide

Concept writing guide Concept development

Concept development Rapid concept screening

Rapid concept screening Concept testing

Concept testing Predicted volume, value and source of business

Predicted volume, value and source of business

Concept development and testing

Concept writing guide

Concept writing, development and iteration is an integral part of new product development and advertising development. Distilling concepts to make them simple is the hardest part of concept writing. The closer to real communication and the more grounded in reality the better. A clear and single-minded concept prevents exposing verbose boring stimulus which only serves to frustrate participants (your target consumers).

It is not possible to realistically communicate your brand architecture through in market communications. A thorough verbose concept may test well (becomes hard to argue with the rationale your concept promotes) but fails to reflect your in-market reality to communicate.

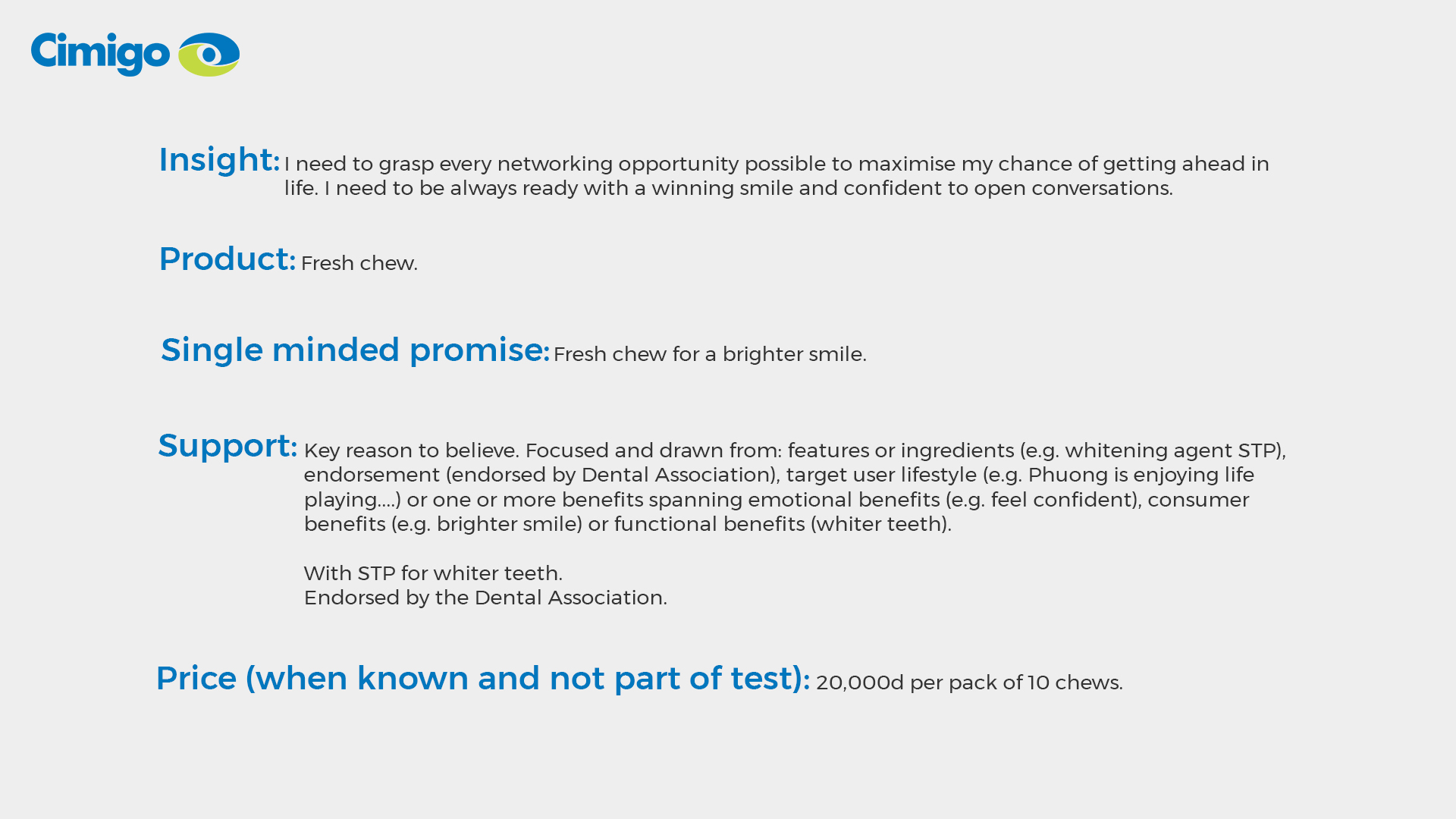

The best concepts are simple and consist of:

Concept development

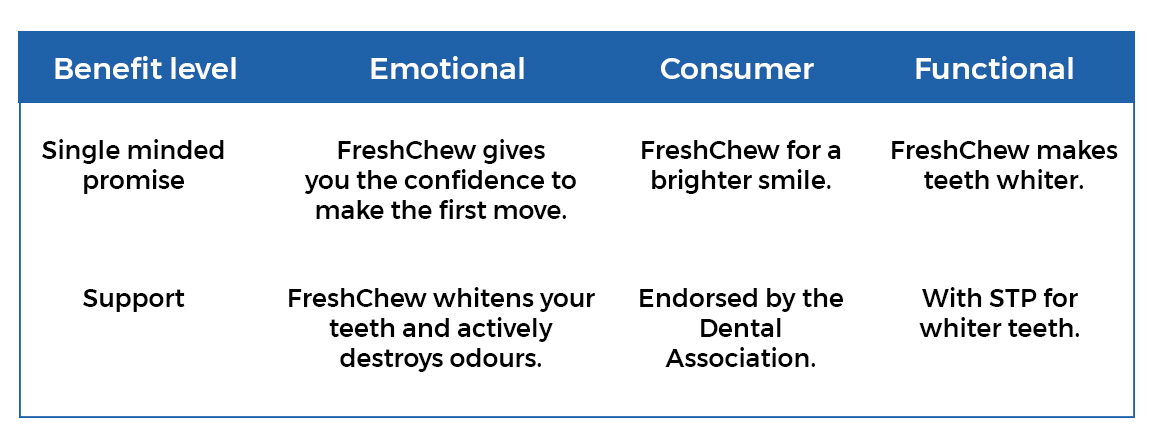

Concept development is iterative to optimise product ideas for your target groups. It typically involves exposing several concepts amongst focus groups with the target group participants. These may be different product ideas or the same product with a different benefit focus; emotional, consumer of functional benefits. Exposing concepts which are directionally different in their proposition and the key supporting benefits helps learn at what level it is necessary to communicate.

For example

This helps to unveil which resonate with the consumer and which do not. It helps the moderator to facilitate the participants to optimise the concept, to that which will be the most compelling. Note that the learning from what does not work well, is often the most insightful.

After each focus group discussion, the Cimigo and your team will reconvene to summarise learning’s from the group to allow for refinement and optimisation of the concepts with the objective of having the final proposition messaging at the end of all the group discussions.

The discussion is moderated to provide the target group’s perspective on;

Understand the decision and shopping journey;

- Consideration of products.

- Motivations and barrier towards brands.

- Drivers of brand choice.

- Touch points and the influencers.

Iterative concept development to explore;

- Spontaneous reactions.

- Concept insight (truth, relevance and attraction) ability to impact behaviour.

- Concept benefits and reason to believe.

- Brand name reactions and associations.

- Comprehension and message taken out.

- Relevance.

- Differentiation.

- Credibility.

- Appeal and interest.

- Price and source of business.

Cimigo will help you make better decisions on how to optimise the concept for your target group and help you to determine which to drop and which may have potential to be re-cycled either at a later date or for another target group.

Rapid concept screening

Often there are too many ideas seeking resources and development in Cimigo’s client’s innovation funnels. The ideas may have been developed from the bottom up, following the innovation process. Alternatively, they may be ideas that the client has launched successfully in one country and wish to explore the potential in another.

To help screen and focus on concepts with the best potential, Cimigo will quantitatively screen concepts rapidly, to help make better choices and enable resources to be focused on the best opportunity.

Rapid concept screening offers these advantages:

- Quick and easy to administer.

- Screening of many ideas.

- Learn concept potential immediately.

- Rank prediction of best volume opportunity.

- Any stimulus – concept, print ad, videomatic may be used.

- Filter to ideas to proceed with quickly.

This service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

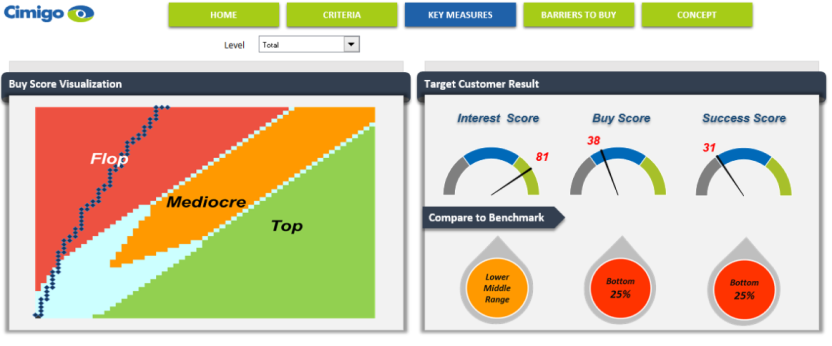

The results rank concept’s by:

- Best volume opportunity.

- Most appealing concept.

- Interest score, buy score and success score.

Concept testing

Validating concepts quantitatively is an integral part of Cimigo’s new product development service. Testing an optimised concept involves validating;

-

Appeal. -

Optimal price. -

Name. -

Pack design. -

Relevance. -

Source of business. -

Pricing. -

Uniqueness.

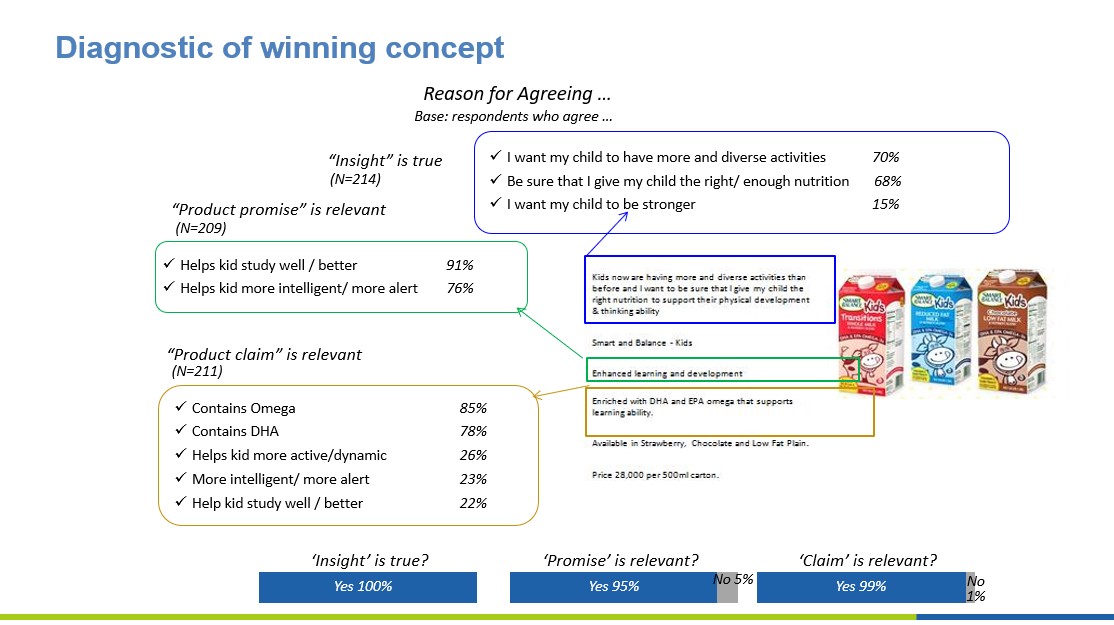

Providing meaningful volume and value forecasts to asses commercial viability requires that Cimigo crack the code of individual buying decisions. Whilst most market modelling merely aggerate the crowd (i.e. all participants to the survey) using overall metrics, Cimigo analyse each individual’s purchase decision. Cimigo then set a validated but tough minimum benchmark for each participant in this concept test survey.

Cimigo’s approach requires that the survey participant response to the concept must be positive on all aspects evaluated. For example, if the pack is not appealing, yet all other factors are, Cimigo recognise that this will not result in a buy decision for this individual. Therefore, even though the overall appeal may be positive, Cimigo do not account for this individual in the volume and value forecasts. It is a tough standard by which to be judged, but produces sales forecasts that have been proven time and time again.

Cimigo’s approach recognises that not all individuals are open to change and also takes into account the individual’s historic engagement with the brand and variant in question. The key metrics that enable Cimigo to make accurate forecasts of commercial success are;

Interest score

It is accepted that not all consumers will be interested to try. This measure assesses the interest to try based on the concept exposed.

Buy score

In order to buy consumers must not reject any key aspect of the concept. If they reject just one it is unlikely that they will buy. The buy score includes all consumers who are positive to all aspects. The key aspects are: overall appealing, promise relevance, claim relevance, uniqueness, design appeal, name appeal and price for pack shown.

Success score

Determines a buying percentage when launching product. Cimigo can predict success and more importantly where concepts will flop.

Cimigo can diagnose the barriers to buy and guide improvements and diagnose the impact of successfully overcoming barriers.

Diagnostics help Cimigo advise you better choices within your concept, what to highlight and what to change.

Predicted volume, value and source of business

Cimigo will use the concept test results to predict volume, value and source of business (including cannibalisation). To do so Cimigo use three further data points (or multiple scenarios thereof in a simulator) which link back to commercial and marketing planning. Specifically:

- Target weighted distribution.

- Target awareness.

- Current volume shares.

Combined this analysis enables to determine key commercial forecasts in accordance with launch planning time frames and the aforementioned targets.

- Penetration.

- Annual volumes (before and after own portfolio cannibalisation).

- Annual values of retail sales (before and after own portfolio cannibalisation).

- Retail share of sales.

This provides the business case support required to justify commercialisation, enabling the launch and management of known barriers to success.