Marketing tactics

Right price for consumers’ brand equity

Right price for consumers’ brand equity Simple price sensitivity test

Simple price sensitivity test Complex price optimiser

Complex price optimiser

Price

Cimigo can best help you make better pricing decisions. Price choices and the necessary solutions differ in their complexity.

Pricing decisions are critical to determine;

Right price for consumers’ brand equity

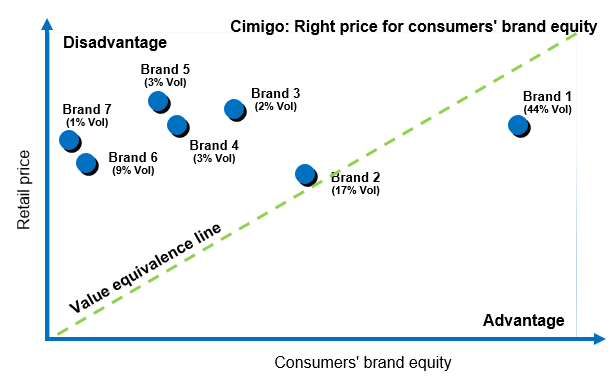

How do you know if you are at the right price point? The chart that both the CEO and CFO most love is below. It helps determine whether the brand’s equity is under or overpriced.

Few brands are overpriced, but too many brands are simply under-priced. Relative to the advantages they bring over competitors the brand could be commanding a greater price. Too many brand owners simply are unaware of the achieved value they have built within their brand’s equity. Too many brand owners leave sales revenue on the shelf as they are under-priced.

Cimigo’s right price for consumers’ brand equity service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

Cimigo can help you make better choices by understanding whether your brand is over or under priced. Cimigo’s brand value model compares the equity across brands in the category, relative to what is driving purchase behaviour and maps these relative to current retail prices.

Some brands (such as brand 2 on the map) have a fair price given the equity that the brand delivers to consumers, hence it sits close to the value equivalence line.

Brand 1 falls in the advantage zone to the right on the brand value equivalence line. This brand delivers far more equity than the price at which consumers pay for it. The brand it being rewarded with significant volume share. This brand owner would be asked to pursue further price research (to understand the impact of higher prices on volume and value shares, as well as margin delivery) to determine the optimal price point. In this example, following further research, the price of brand 1 was increased, delivering slightly less volume share but more margin for the manufacturer.

Brands 3,4,5,6 and 7 all fall in the disadvantage zone to the left on the brand value equivalence line. All of these brands under deliver equity relative to their price position. They need to understand consumer drivers in the category and build their equity and whilst building they will need to re-consider their pricing tactics. Many in this example were already depending on promotions to move stock.

Simple price sensitivity test

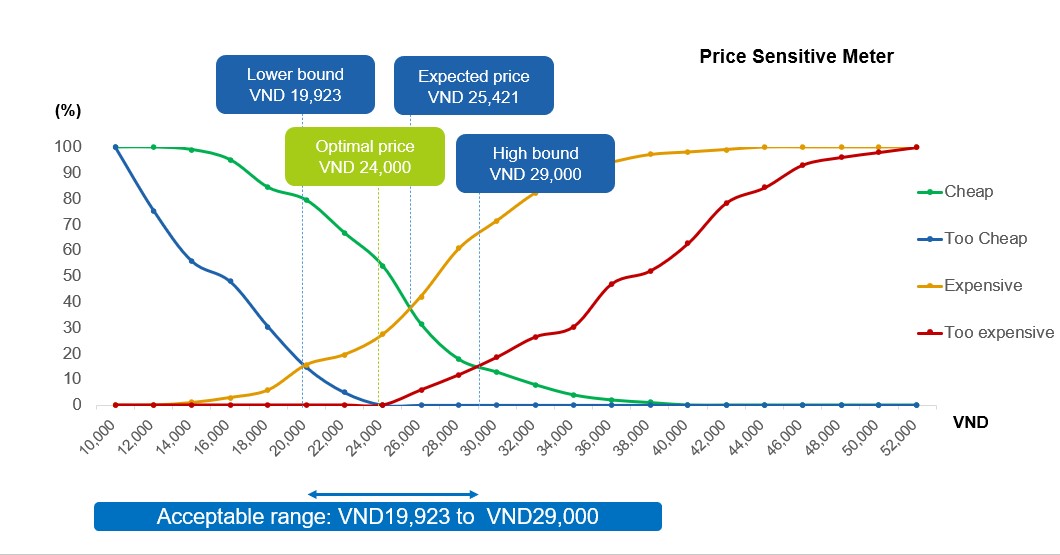

Cimigo applies a simple price sensitivity meter model to determine acceptable price range and the optimal price therein. Consumers are asked at which price the brand being tested is;

- Too expensive: at what price do you perceive the product as too expensive to the point where you would not consider this product?

- Too cheap: at what price do you perceive the product as too cheap to the point where you would feel that the quality cannot be very good?

- Expensive: at what price do you perceive the product is getting expensive, but you would still consider buying it?

- Bargain: at what price do you perceive the product to be a bargain – a great buy for the money?

In this example, the optimal price is VND 24,000. The acceptable range is from VND19,923 to VND29,000. Beyond this range too much demand is lost.

Cimigo’s price testing service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

Complex price optimiser

A more advanced pricing solution is the Cimigo price optimiser, this test deploys discrete choice modelling. Discrete choice modelling assesses how different combinations of the chosen product attributes (brand, pack and price) are likely to affect sales volumes and values.

This approach is best used in situations where significant, high risk decisions are being made. It is the most robust method for estimating market share that Cimigo know of, short of undertaking a test market. It is intended to simulate the actual purchase decisions as closely as possible by simulating all the consumer choices where consumers make holistic choices.

Discrete choice modelling is perfectly matched for portfolio management issues because numerous brands can be included in the experimental design. It captures interaction effects so that it is possible to evaluate the price sensitivities by brand. It will provide the volume and thus value share in different price scenarios.

The main benefits of Cimigo price optimiser over other approaches are:

- Realistic stimulus – real pack pictures with prices.

- Realistic consumer tasks which simulate the actual purchase decisions as closely as possible by simulating choices where consumers make holistic choices.

- Disguised task owing to the use of randomisation and a statistically robust experimental design, respondents cannot establish the purpose of the research as they see no relationship between prices and brands.

- Explicit estimates of market share, which unlike other approaches that involve rating scales or purchase intent scores, the discrete choice model output is choice.

- Interaction effects are captured – so that it is possible to evaluate the price sensitivities by brand.

Using the brand, variant and price range as inputs, ‘choice tasks’ are generated through a systematic factorial design. Each such choice task will contain brand variant photos with the price levels indicated.

These variables will fit into a regime where different scenarios will be presented to your target consumers. As one consumer cannot see all scenarios, groups of consumers will see different scenarios. All consumers will see the scenario with the current range at current prices. Consumers will be asked to ‘purchase’ for requirements for their household for the next 7 days (or appropriate time frame).

Cimigo provide an easy-to-use Excel based simulator, showing the results of the model in any pricing scenario, within the scope of the design. The simulator will include profitability analysis, where margin and cost have been provided to Cimigo. This enables profitability to be calculated under different pricing strategies.