Indonesia car survey: overcoming barriers of car purchase

Oct 08, 2024

Demand for passenger cars is declining The Indonesian automotive market in 2024 presents both

Indonesia digital finance survey: e-wallet apps and its paylater feature

Digitalization is an inevitable aspect of our fast-paced era, providing ease of access and transactions, which are key reasons why people are embracing the digital age, including in economic activities. This trend prompted Cimigo to conduct a brief market research to check the current situation of the digital economy in Indonesia, with a focus on e-wallet usage. E-wallet apps have been around for quite many years in Indonesia, contributing to the growing familiarity and adoption among the population. According to the survey results, Cimigo found that it is already well-known among Indonesians, as reflected by the fact that 81% of the participants are currently using e-wallets. In average, people use around 2 to 3 different e-wallet apps.

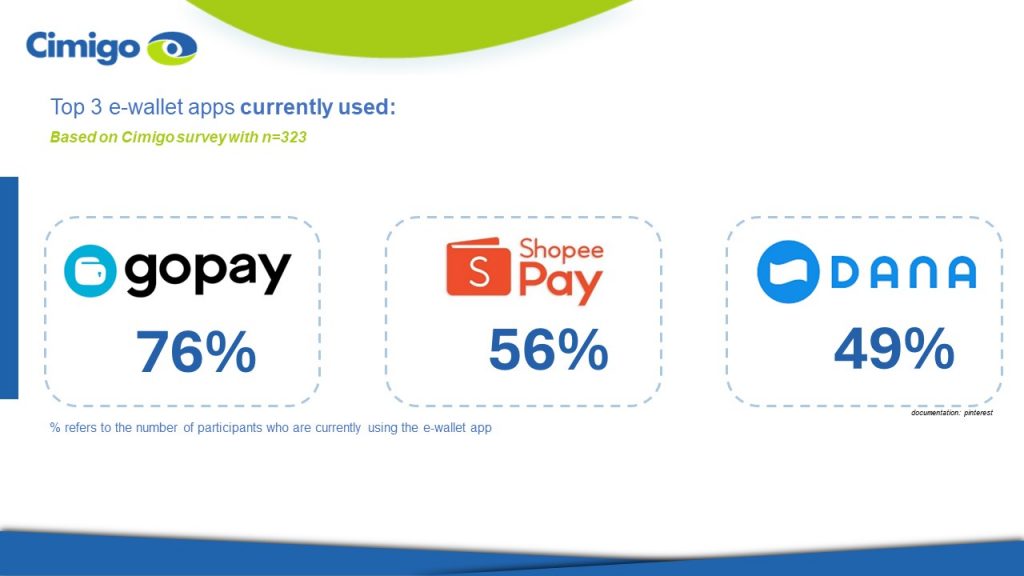

Among the various e-wallet services available in Indonesia, GoPay is the most widely used with 76% are currently using it. ShopeePay follows closely with 56%, and Dana with 49%.

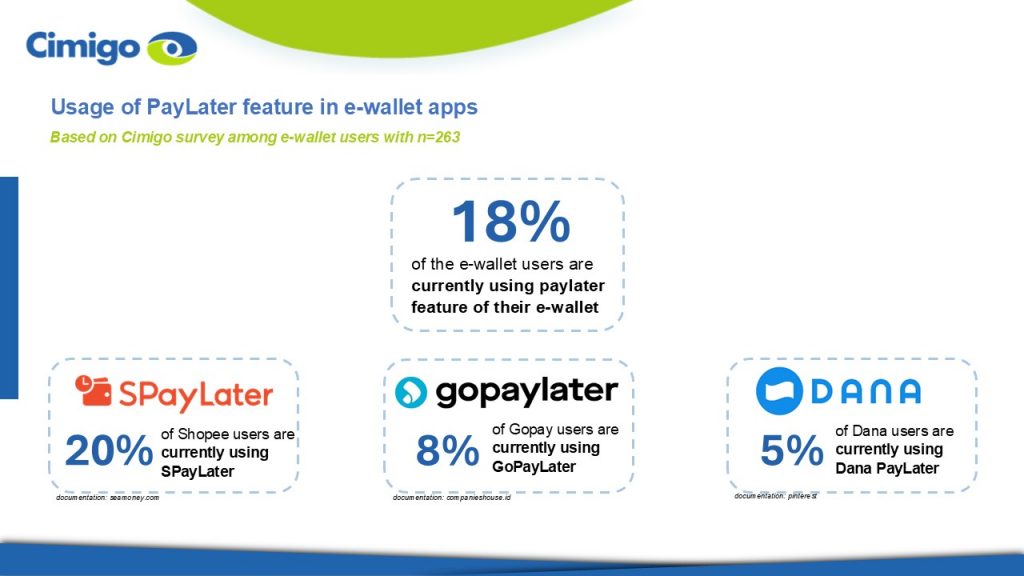

Additionally, some e-wallets also feature a Buy Now Pay Later (BNPL) option, more popularly known as paylater, a service that allows users to defer payments or make purchases on credit and pay at a later date. However, the majority of our participants stated that they have never used the paylater feature on their e-wallets. The paylater feature represents a significant opportunity for financial inclusion, offering consumers more flexibility in managing their finances. As awareness and understanding of this feature grow, it could potentially drive higher adoption rates and reshape consumer spending behavior.

The widespread use of e-wallets in Indonesia reflects the country’s rapid digital transformation. As digital payment solutions continue to evolve and expand, they are likely to play an even more significant role in the daily economic activities of Indonesians, shaping the future of the nation’s digital economy. The integration of features like paylater could further enhance the convenience and accessibility of digital transactions, paving the way for a more inclusive financial landscape.

End.

Indonesia car survey: overcoming barriers of car purchase

Oct 08, 2024

Demand for passenger cars is declining The Indonesian automotive market in 2024 presents both

Vietnam retail banking 2024

Sep 17, 2024

Unlocking the future of retail banking Vietnam retail banking 2024 The world of retail banking is

Vietnam uninterrupted: a twenty-year journey

Mar 18, 2024

Trends in Vietnam: Vietnam uninterrupted: a twenty-year journey Trends in Vietnam. Witness

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Janine Katzberg - Projects Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Please enter the information for free download.

The report will be sent to your email.