Indonesia car survey: overcoming barriers of car purchase

Oct 08, 2024

Demand for passenger cars is declining The Indonesian automotive market in 2024 presents both

Indonesia economic performance Q2 2024

The second quarter of 2024 presents a mixed yet cautiously optimistic picture for Indonesia’s economy. While some sectors show resilience and growth, others face challenges that signal potential headwinds. In this article on Indonesia economic performance, Cimigo analyses key economic indicators to provide a thorough understanding of where Indonesia’s economy stands and where it might be headed.

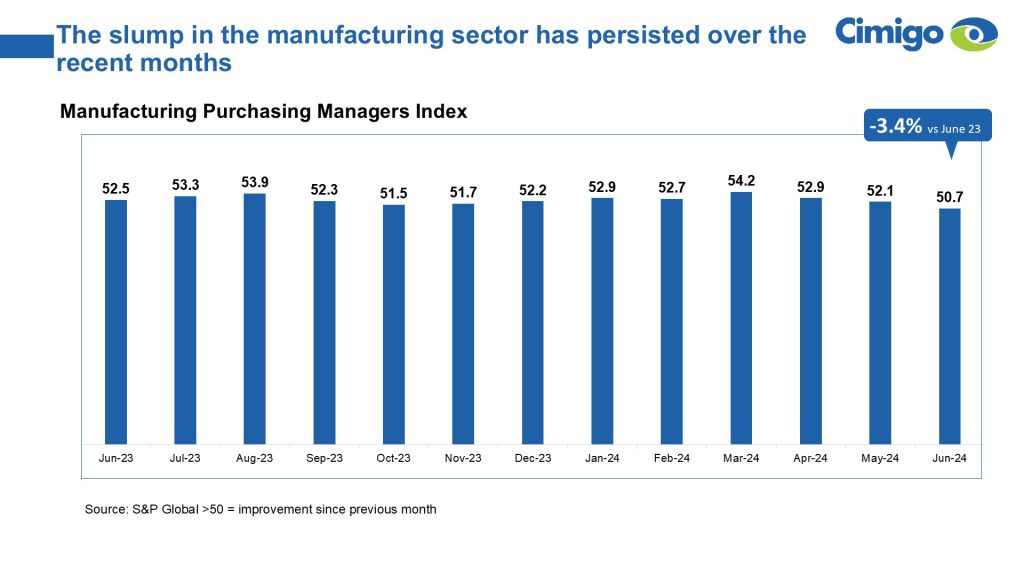

The manufacturing sector in Indonesia has experienced a downturn in recent months. The Manufacturing PMI, a critical indicator of the sector’s health, has consistently declined from 52.5 in June 2023 to 50.7 by June 2024, marking a 3.4% year-on-year fall. This suggests that manufacturing is facing challenges, particularly in terms of new orders and general sentiment. Nevertheless, the broader industrial production grew by 3.95% in the same period, indicating that while manufacturers are cautious, actual output remains strong.

This juxtaposition suggests that while sentiment may be down, the capacity for production remains intact, providing some buffer against further economic downturns. Businesses in this sector should remain vigilant, especially regarding supply chain issues and volatile demand, which could affect margins.

Despite the manufacturing slowdown, the overall business outlook in Indonesia is cautiously optimistic. The growth in exports (1.9%) and imports (1.8%) during this period points to a balanced trade environment. These figures suggest that while businesses are proceeding with caution, the economic environment remains conducive to growth.

Cimigo projects that this balanced approach, with the GDP growth in Q2 2024 of 5.05%, will sustain GDP growth at a modest 5.1% throughout 2024. However, companies should prepare for potential challenges, including narrowing margins and external economic pressures.

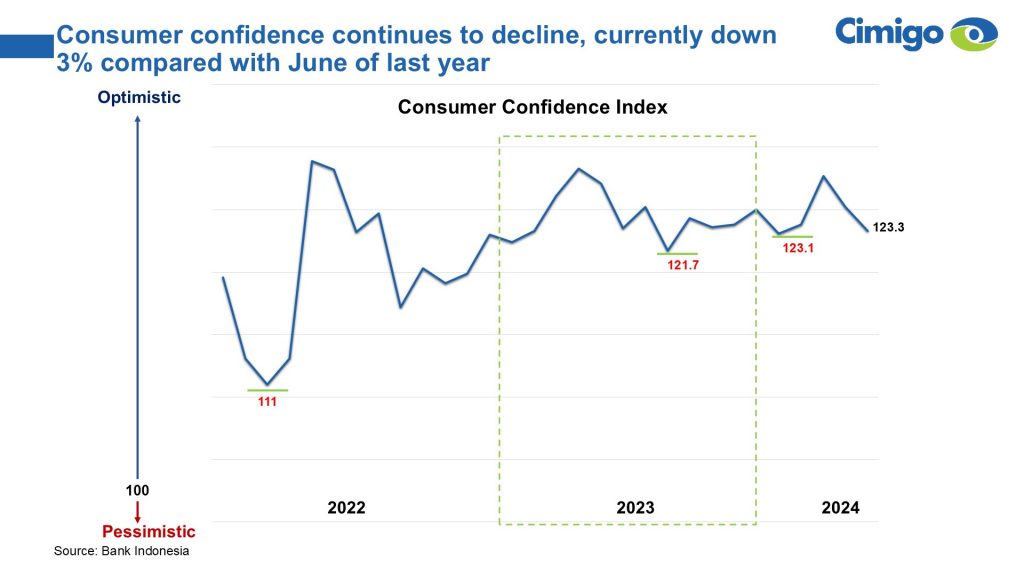

Consumer confidence in Indonesia has seen a decline, dropping 3% compared with June of the previous year. This downward trend is particularly pronounced among older generations, while younger cohorts (Gen Z and Gen Y) remain relatively more optimistic about the future. The Consumer Confidence Index (CCI) stood at 123.3 in June 2024, down from 121.7 in the previous year, signalling a more cautious outlook among consumers.

This decline in confidence correlates with a challenging job market, where 74% of respondents reported difficulty finding employment. This could potentially affect consumer spending patterns, with a shift towards more value-driven purchases.

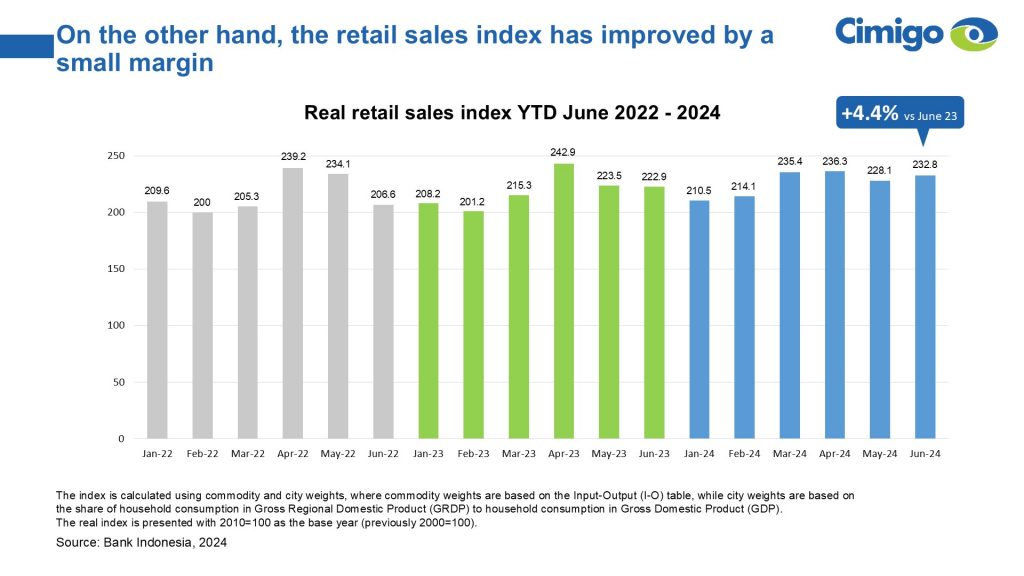

Despite the challenges in manufacturing and consumer sentiment, retail sales have shown a modest improvement. The real retail sales index recorded a 4.4% year-on-year increase as of June 2024, primarily driven by essential goods sectors such as food, beverages, tobacco, and motor vehicle parts. These sectors have demonstrated resilience, suggesting that consumer spending is recovering, albeit unevenly.

However, the uneven recovery emphasizes the importance of focusing on value-driven products, especially in sectors that cater to more cautious consumers. Businesses in these industries should make the most of the steady demand while remaining alert to shifts in consumer priorities.

Indonesia economic performance in Q2 2024 is characterised by a complex blend of resilience and caution. While the manufacturing sector faces headwinds, other areas like retail sales and industrial production show signs of strength. Consumer confidence is in slight decline, but younger generations remain hopeful, providing a potential buffer against further economic slowdowns.

As Indonesia navigates these challenges, businesses must remain adaptable, focusing on sectors that show growth potential while preparing for possible shifts in the economic landscape. With cautious optimism, Indonesia is poised to maintain steady, if modest, economic growth through 2024.

Indonesia car survey: overcoming barriers of car purchase

Oct 08, 2024

Demand for passenger cars is declining The Indonesian automotive market in 2024 presents both

Vietnam retail banking 2024

Sep 17, 2024

Unlocking the future of retail banking Vietnam retail banking 2024 The world of retail banking is

Vietnam uninterrupted: a twenty-year journey

Mar 18, 2024

Trends in Vietnam: Vietnam uninterrupted: a twenty-year journey Trends in Vietnam. Witness

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Janine Katzberg - Projects Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Please enter the information for free download.

The report will be sent to your email.