Changes in Vietnamese consumer behaviour during Covid have intensified during the series of city-wide social distancing measures that have impacted cities across Vietnam in late May and June 2021. This article explores the key changes impacting consumer dynamics in Vietnam.

Richard Burrage

8 minute read

Summary of changes in Vietnamese consumer behaviour during Covid

Household financial pressure puts the brakes on Vietnamese consumer discretionary expenditure. One of the most prominent changes in Vietnamese consumer behaviour is apparent in consumers seeking value for money propositions to reduce the stress on their household budgets.

Vietnamese consumers are holding back long-planned purchases and delaying them until their confidence in their income stability returns. Some changes in Vietnamese consumer behaviour are forced on consumers through social distancing measures. Consumers are not able to spend on out-of-home entertainment, eating out-of-home nor enjoy spa and beauty services.

The winners from changes in Vietnamese consumer behaviour continue to be online shopping platforms, which have further propelled delivery and ride-sharing services. The desire to be contactless and the convenience of mobile payments in Vietnam is diminishing the use of cash on delivery, slightly, a push that e-payments really need.

Temporary positive changes in Vietnamese consumer behaviour exist for numerous fast-moving consumer products relating to hygiene and preventing transmission. As and when Covid dissipates these categories will reverse to their typical growth trajectories last seen in 2019.

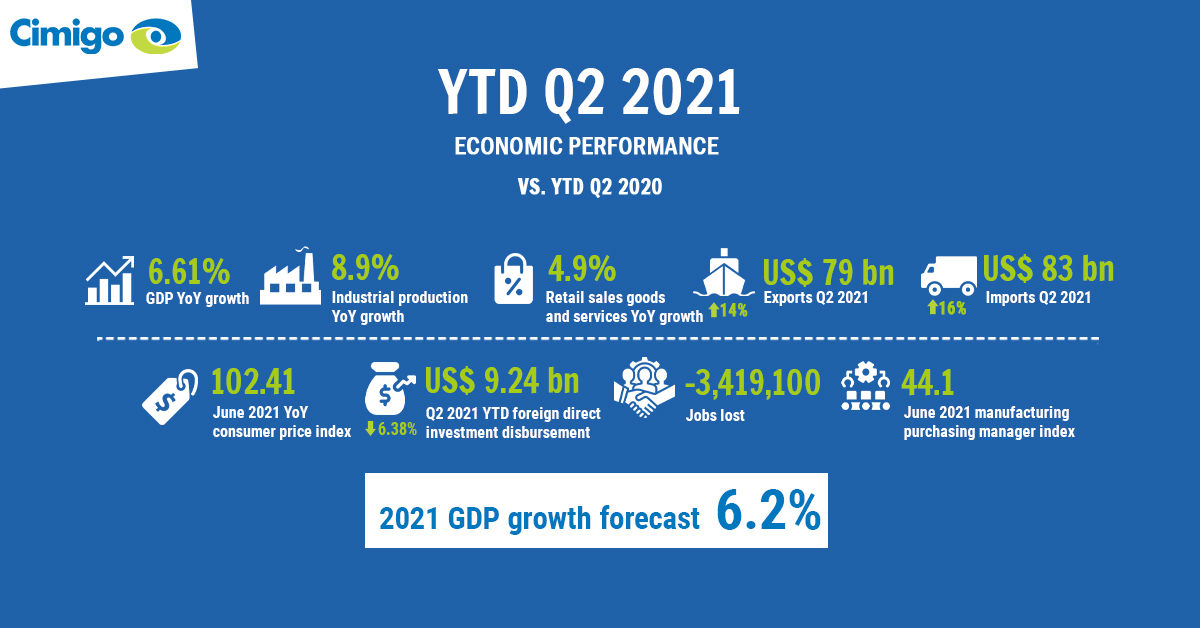

1. Vietnam economy 2021 YTD performance Q2 2021

Some households have been hard hit with job losses and lower household income for most households. Whilst the economy continues to grow in the first half of 2021, household incomes are taking a harder hit than they experienced in 2020.

Some households have been hard hit with job losses and lower household income for most households. Whilst the economy continues to grow in the first half of 2021, household incomes are taking a harder hit than they experienced in 2020.

2. Household financial pressure puts brakes on Vietnamese consumer discretionary expenditure

Whilst many, but not all, parts of the manufacturing economy continue to function; trade, services, hospitality and tourism have been curtailed. In 2020 Cimgio reported that the pandemic had reduced annual household incomes by an average of 12%. Job losses have already doubled those experienced in 2020. As of July 1st 2021 Cimigo anticipate the impact will be harsher than 2020 on household incomes, impacting both savings and expenditure. All discretionary expenditure is being re-evaluated.

Whilst many, but not all, parts of the manufacturing economy continue to function; trade, services, hospitality and tourism have been curtailed. In 2020 Cimgio reported that the pandemic had reduced annual household incomes by an average of 12%. Job losses have already doubled those experienced in 2020. As of July 1st 2021 Cimigo anticipate the impact will be harsher than 2020 on household incomes, impacting both savings and expenditure. All discretionary expenditure is being re-evaluated.

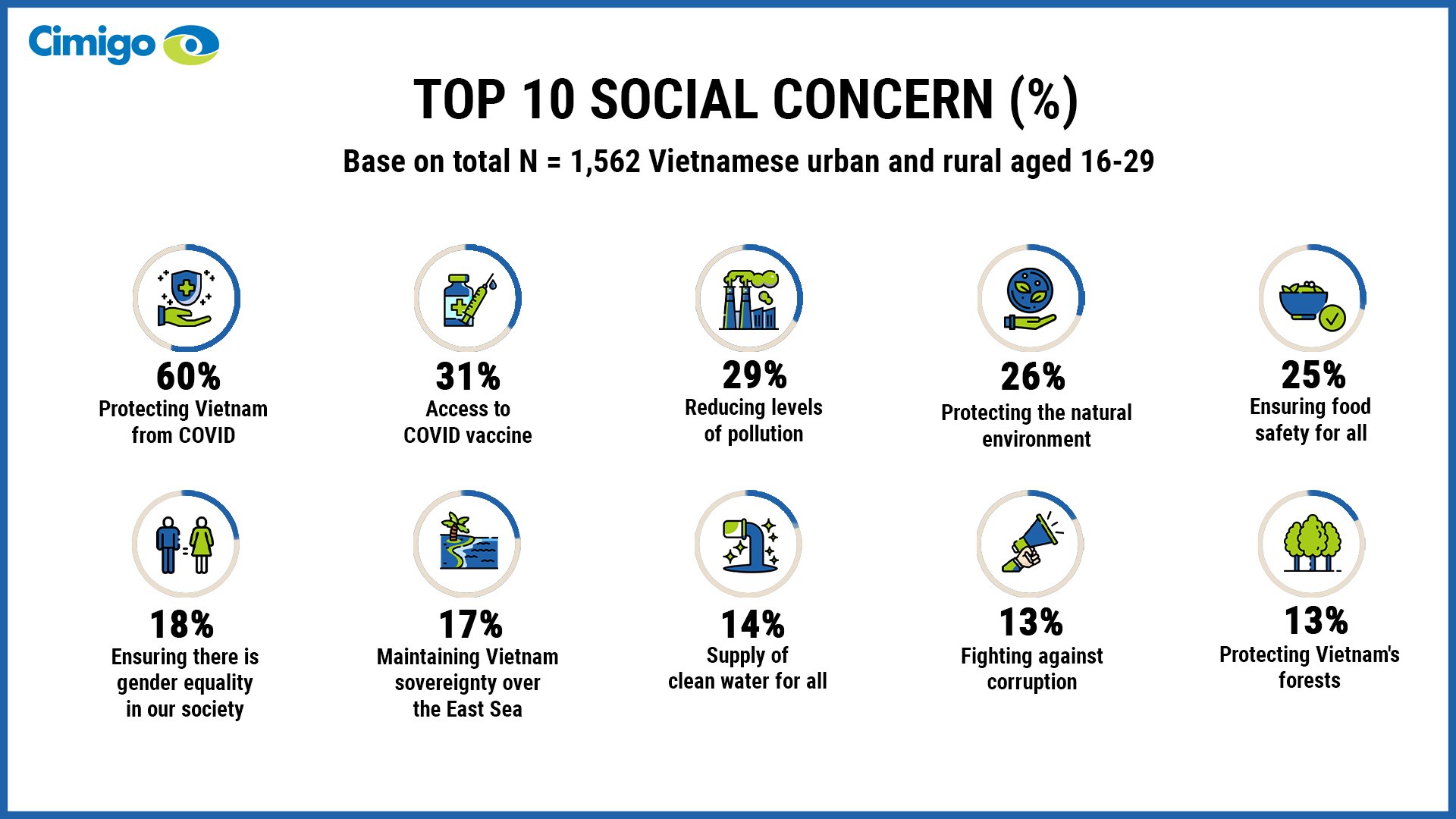

3. Covid paramount concern to 7 in 10 Vietnamese consumers

Cimigo’s survey of the digital generation aged 16 to 29, across rural and urban Vietnam in May 2021 found that protecting Vietnam from Covid was the number one concern by a large margin.

4. Vietnamese consumers seeking better value

4. Vietnamese consumers seeking better value

Vietnam household income shortfalls derailed the historic premiumisation trends of consumer-packaged goods. One of the most prominent changes in Vietnamese consumer behaviour is apparent in consumers seeking value for money propositions to reduce the stress on their household budgets. Down trading in consumer-packaged goods will continue strongly through 2021. Consumer packaged goods (CPG) are experiencing significant down trading, as consumers are thrifty with their expenditure.

Vietnam household income shortfalls derailed the historic premiumisation trends of consumer-packaged goods. One of the most prominent changes in Vietnamese consumer behaviour is apparent in consumers seeking value for money propositions to reduce the stress on their household budgets. Down trading in consumer-packaged goods will continue strongly through 2021. Consumer packaged goods (CPG) are experiencing significant down trading, as consumers are thrifty with their expenditure.

5. Vietnamese consumers delay high ticket purchases

In 2020 the changes in Vietnamese consumer outlook led to the delay of purchasing new or replacement high ticket price purchases. This has re-emerged as consumers hold back long-planned purchases and delay them until confidence in their income stability returns. Apartments, motor vehicles (2 and 4 wheels), home appliances, electronic devices and home furnishing purchases are all further delayed.

In 2020 the changes in Vietnamese consumer outlook led to the delay of purchasing new or replacement high ticket price purchases. This has re-emerged as consumers hold back long-planned purchases and delay them until confidence in their income stability returns. Apartments, motor vehicles (2 and 4 wheels), home appliances, electronic devices and home furnishing purchases are all further delayed.

6. Vietnamese domestic tourism and consumer out-of-home expenditure is shut down

Some changes in Vietnamese consumer behaviour are forced on consumers through social distancing measures. Domestic tourism (the one remaining lifeline for the travel and tourism industry since borders were closed to inbound tourists) can no longer travel easily domestically. Most consumer-facing service businesses have already lost six weeks of trading, as they have been subject to more stringent regulations. Consumers are not able to spend on out-of-home entertainment, eating out-of-home nor enjoy spa and beauty services.

Some changes in Vietnamese consumer behaviour are forced on consumers through social distancing measures. Domestic tourism (the one remaining lifeline for the travel and tourism industry since borders were closed to inbound tourists) can no longer travel easily domestically. Most consumer-facing service businesses have already lost six weeks of trading, as they have been subject to more stringent regulations. Consumers are not able to spend on out-of-home entertainment, eating out-of-home nor enjoy spa and beauty services.

7. Vietnamese online shopping platforms are the biggest winner from changes in Vietnamese consumer behaviour

The winners from changes in Vietnamese consumer dynamics continue to be online shopping platforms that have already expanded penetration, transaction volumes and “basket’ size over 2020, propelling a massive 54% increase in e-commerce sales in Vietnam in 2020. This ensues with Covid proving a helping push, it has helped the channel build both consumer familiarity, trust and right now dependency.

The winners from changes in Vietnamese consumer dynamics continue to be online shopping platforms that have already expanded penetration, transaction volumes and “basket’ size over 2020, propelling a massive 54% increase in e-commerce sales in Vietnam in 2020. This ensues with Covid proving a helping push, it has helped the channel build both consumer familiarity, trust and right now dependency.

8. Delivery and ride-sharing have been accelerated by changes in Vietnamese consumer behaviour

Most service and trading businesses have been working from home. This along with the stratospheric rise in e-commerce has further propelled delivery and ride-sharing services on both the demand side and also the expansion of existing players and the entry of new players.

Most service and trading businesses have been working from home. This along with the stratospheric rise in e-commerce has further propelled delivery and ride-sharing services on both the demand side and also the expansion of existing players and the entry of new players.

Both online gaming and content streaming through the likes of YouTube, TikTok and Qiy have accelerated as consumers have spent less time out of home and more time on their smartphones.

9. E-wallets have benefited from changes in Vietnamese consumer behaviour

The desire to be contactless and the convenience of mobile payments in Vietnam is diminishing the use of cash on delivery slightly, a push that e-payments really need. The vast majority of shoppers prefer cash on delivery for the control this affords the consumer should products not meet expectations.

The desire to be contactless and the convenience of mobile payments in Vietnam is diminishing the use of cash on delivery slightly, a push that e-payments really need. The vast majority of shoppers prefer cash on delivery for the control this affords the consumer should products not meet expectations.

10. Temporary changes in Vietnamese consumer behaviour

Numerous fast-moving consumer products relating to hygiene and preventing transmission have experienced strong growth during the pandemic. These include hand sanitiser, masks, even regular bar and liquid soap, body wash and following rumours of Covid festering in our throats, mouthwash.

Numerous fast-moving consumer products relating to hygiene and preventing transmission have experienced strong growth during the pandemic. These include hand sanitiser, masks, even regular bar and liquid soap, body wash and following rumours of Covid festering in our throats, mouthwash.

The following categories have seen a tremendous upside as a result of Covid.

- Food and beverage delivery.

- Hoarding of consumer-packaged foods in case of stay-at-home orders.

- Health supplements to maintain health and build stronger immunity.

- Books and stationery for home entertainment and schooling.

- Electrical accessories to enable better in-home streaming entertainment and gaming.

- Sports apparel to embrace healthier lifestyle choices.

As and when Covid dissipates these categories will reverse to their typical growth trajectories last seen in 2019.

11. Start marketing planning now to stay ahead of the big bounce back

Read Cimigo’s approach on marketing planning to stay ahead of the big bounce back. The pandemic has forced changes in consumer behaviour. Life will not return to normal, a new normal will evolve with new habits and rituals. Consumer mindsets and behaviours have changed, some will be temporary but others will become permanent. These changes will need to be rapidly understood and your product, price, positioning and channel will need to be adjusted.

Contact us at ask@staging.cimigo.com if you need help.