Market research company Cimigo reports on the Vietnam consumer market trends 2016. The report was presented at the Vietnam Market Research Trends 2016 organised by M2 – Marketing & Media Network. The report can be downloaded here. The transformation of Vietnam between 2005 and 2015 demonstrates the rapidly changing consumer marketing environment. The report highlights the ten Vietnam consumer market trends in 2016, impacting the purchase priorities of consumers in Vietnam.

10 Vietnam consumer market trends 2016 impacting purchase priorities

1. High income households double in 10 years in Vietnam.

2. Life stages in Vietnam are maturing. Kids are less influential in determining purchase priorities.

3. The rise of new retail chasing share before profits in Vietnam.

4. The rise beer clubs, cafes and casual fast service restaurant chains grow in Vietnam.

5. Health consciousness in Vietnam translates into action and spend.

6. Conspicuous consumption has always been mobile in Vietnam.

7. Keeping up with the Nguyen’s with consumer finance in Vietnam.

8. Self expression immediacy in Vietnam.

9. Mobile drives internet penetration and habits in Vietnam.

10. Consumers in Vietnam shift from brand ownership to new experiences.

High income households double in 10 years in Vietnam

The first of the Vietnam consumer market trends 2016 is the rise in purchase power. Over the past 10 years Vietnam has experienced rapid economic development. The number of high income households earning over US$500 per month per household, has risen from 1.8 million to over 4 million.

The Vietnam economy tripled in size over 10 years

Over the same period the size of the Vietnam economy has nearly tripled to USD175 billion. With population growth at just under 10% Vietnam’s population is now just over 91 million. Gross domestic product (GDP) per capita is now at US$1,923 per person.

Vietnam advertising expenditure grew nearly 600% in 10 years

Advertising expenditure in Vietnam grew 579% from US$280 million in 2005 to a US$1.93 billion in 2015. TV is still king dominating spend at over 75% of all spend. Digital advertising expenditure whilst the fastest growing is only at estimated US$62 million. Advertising has grown far faster then the economy, this is only in minor part owing media inflation, the vast majority of the increase, represents increasing numbers of brands scrambling for a voice and the rise of domestic companies (especially in foods, beverages and healthcare) embracing the consumer economy in Vietnam.

Life stages in Vietnam are maturing

The second of the Vietnam consumer market trends 2016, is the maturing of life stages. Vietnam’s population by life stage has under gone a major transformation in between 2005 and 2015. Young singles, young married couples with no children and young married couples with a child less than 10 years of age have all declined in absolute numbers. Vietnam’s population and household structures are changing by life stage, with children’s pester power having a declining influence on household purchase priorities.

The life stage with the strongest growth is old and single having growth of 74% over 2005 to just over 10 million people. Empty nester’s, where the children have grown up and left home, have increased 63% and those married with the youngest child aged more than 9 and less than 20 have increased by 36%. These changes in Vietnam’s population life stages have a strong impact on purchase priorities, children receive a disproportionate focus in household spend as parents seek to leverage opportunities for their children, that they feel they themselves missed out on. This has an impact on baby care, infant milk formula, children’s beverages and snacks and off course larger ticket items including education, insurance and tourism.

Vietnam’s population by life stage will have changed radically by 2025 with fewer than 30 million people being in the empty nester and old single life stages. This demographic shift in Vietnam will see a population with 33 million young singles, nearly 14 million empty nester’s and just over 16 million old singles.

Kids are less influential in determining purchase priorities

Ponder the fact that in 2005 one third of households had no dependent children. In 2015 44% of households had no children and by 2025 nearly 60% of households will have no dependent children. The shopping basket (or perhaps delivery box) will look vastly different than today with major implications for consumer goods and a huge potential opportunity for services in Vietnam.

The rise of new retail chasing share before profits in Vietnam

The third of the Vietnam consumer market trends 2016 is the rise in modern and convenient retail.

Supermarkets and shopping mall expansion in Vietnam

The number of supermarkets in Vietnam has risen form 47 in 2005 to 975 today.

Following on the tails of early entrants Diamond Plaza (opened in 1999) and Parkson (opened first mall in 2005 and has 8 as of December 2015), shopping malls are on the rise, lead by the exponential expansion of Vincom shopping centres, with 19 centres in 2015 and many more in the pipeline. Private equity firm Warburg Pincus, which has invested a total of $300 million in Vincom Retail of Vingroup to for their mall, mini mart and e-commerce expansion. Foreign entrants Lotte, Robins, Aeon and Emart all opened new malls in 2015.

Modern self service convenience accelerates in Vietnam

In 2005 there were 135 modern self service stores, mostly independently owned and managed. Today there are over 1,800 modern self service stores, mostly part of chains after an intense year of merger and acquisitions in Vietnam retail industry. To the casual observer the rise is modern self service stores in Vietnam is anecdotal evidence of the rise in Vietnam’s middle class. In reality the vast majority of this new modern convenient retail is excess investments funding a race to capture future exit (or listing) valuations, a long play and for many, a high stakes gamble. Local operators include VinMart+ and B’s Mart and foreign operators such as Circle K, Shop&Go, FamilyMart and Aeon Citimart. Yet there are still more to come in 2016, with the imminent entry of both Seven Eleven and AuchanSuper.

These numbers refer to modern (well lit, with aisles and air conditioning) and self service (shoppers may browse, select and pay at the counter) and include mini marts and convenience stores. However the most are not operating at a profit and are investing in a future that is less than certain, with a race to dominate retail space and are currently buying market share.

Despite the rise in modern self service retail outlets there are been no growth in modern trades contribution to grocery retail sales, which remains dominated by traditional trade (traditional trade still contributes over 80% of general grocery sales now as it did in 2005). Most traffic at convenience stores is dominated by students and first jobbers, using them as on premise snacking venues (with the advantage of air conditioning and wifi).

Consumer shopping behaviour in Vietnam

As in 2005, in 2015 traditional grocery stores still count for over 80% of grocery sales. Despite all the new modern trade stores, the modern trade contribution to retail sales in Vietnam has not shifted. The convenience store operators are inhibited by ingrained consumer shopping behaviour in Vietnam where the traditional grocery trade involves four critical factors. Firstly, traditional grocery is ubiquitous and hence extremely convenient. Secondly, household purchasers maintain long term and trusting relationships with sellers who are the owner and operator (and often their own landlord) at these stores. Thirdly, the diet in Vietnam is fresh food based and therefore shopping trips for food stuffs are daily and this shopping basket in Vietnam is predominantly fresh food produce (unavailable at convenient stores and a limited choice at mini marts). Fourthly, most shoppers do not need to get off their motorbike when visiting their traditional neighbourhood grocery store, which is hard to beat for convenience!

The rise of e-commerce in Vietnam

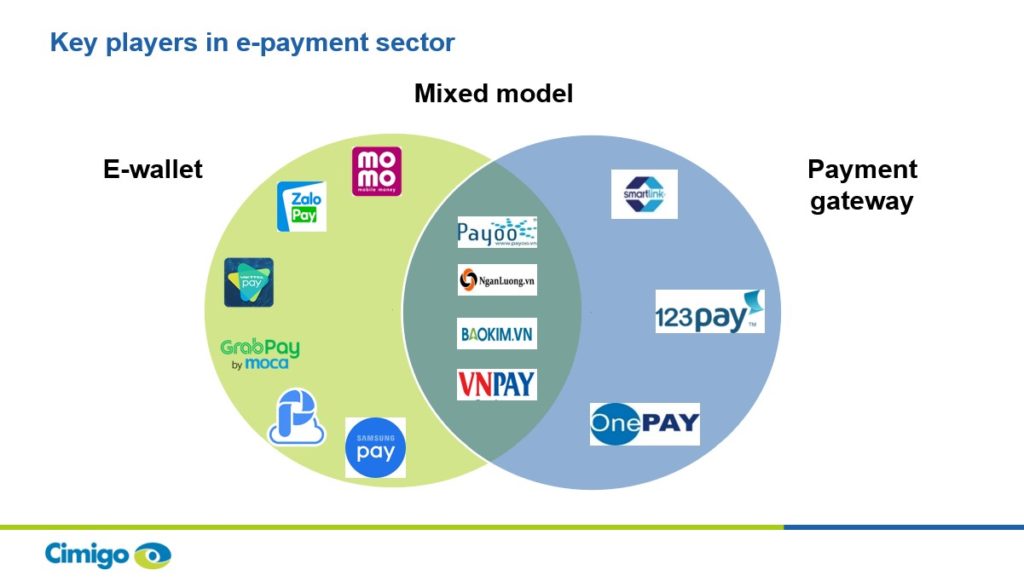

E-commerce represents yet another false economy for many casual observers. In 2005 e-commerce was essentially scratch cards used to extreme profitably for internet games at internet cafes. Despite Vietnam being a cash payment economy in 2015 there are over 20 e-payment and e-cash service providers fighting for domination in Vietnam’s e-commerce market servicing over 50,000 e-commerce sites. The race here is on for transaction volumes to attract funding; successful for some such as Momo.

Online shopping is strongest for gaming, utilities, mobile top up, fast fashion, travel, health supplements and household appliances to date. Despite the hype most of the e-commerce platforms are burning through investor’s funding whilst subsidising discounted prices as they buy market share, transaction volume growth and ultimately more investment funds.

The latest evidence is the owners of Lazada and Zalora and selling to Alibaba as the latter dives into South East Asia. In Vietnam where cash dominates payments, these platforms provide the extreme convenience of cash on delivery eliminating any shopper risk in online shopping and inhibiting any benefits from and the move to e-payments.

The only winners in this race are Vietnamese online shoppers, the few investors lucky enough to realise a return will likely find it from other investors, ultimately very few online shopping platforms will realise an operating success.

The rise beer clubs, cafes and casual fast service restaurant chains grow in Vietnam

The fourth of the Vietnam consumer market trends 2016 is the growth in coffee, beer and fast service restaurant chains.

Beer clubs proliferate, per capita consumption reaches 36.75 litres per person in 2015

Beer clubs such as Vuvuzela (14 beer clubs from Golden Gate Group), Fox Beer Club, Beer Club V and a plethora of similar venues have been in places for the past few years.

Branded cafe chains growth in Vietnam

Branded cafe chains have followed on the success of Highlands Coffee (98 outlets in Vietnam initially built by Viet Thai International Company and now owned by Jollibee Foods Corp) and Trung Nguyen with over 1000 outlets but without a consistent chain environment nor service. International brands now include; Starbucks (19 outlets by Maxims), Coffee Bean and Tea Leaf (16 outlets), MOF (9 outlets), Angel-in-us Coffee (5 outlets by Lotte Group), NYDC (5 outlets), Cafe Benne (5 outlets) and Gloria Jean’s (3 outlets) and new entrant Holly’s Coffee (2 outlets).

The rise is not only foreign brands but local brands such as vertically integrated Phuc Long Cafe (14 outlets), Coffee House (10 outlets by Seedcom) and the Coffee Factory (3 outlets). Other rapidly expanding chains include Urban Station (33 outlets), Passio Coffee (20 outlets) and Our Matcha and Cafe (4 outlets).

Bubble tea is on the rise at menus in many of the aforementioned cafes, especially Phuc Long Cafe but bubble tea chains are also on the rise with the likes of Chattime (2 outlets), Tien Huong (2 outlets) and Hot & Cold (1 outlet).

Branded fast service restaurants and casual dining chains grow in Vietnam

Asian casual dining and fast service restaurants have been on the rise since the early franchiser Pho 24 (71 outlets – acquired in 2013 by Viet Thai International Company and Jollibee Foods Corp) took the market by storm. Banh Mi Que Tam (95 outlets) quietly leads the way on store counts. Mon Hue (60 outlets), Pho Ong Hung (33 outlets), Com Tho Chay (13 outlets – previously branded Com Express) all from Huy Vietnam Group Limited which has 112 restaurants under 4 brands and raised US$15 million in 2015 for further expansion. Kichi Kichi (22 outlets) from Golden Gate Group, which has developed 150 restaurants across 19 concepts since 2005. Wrap and Roll (10 outlets) looks set to expand further in 2016.

Western casual dining and fast service restaurants continue to proliferate since early entrant KFC (opening their first outlet in 1997, in 2015 KFC had 128 outlets by Yum! Brands Inc and Jardine Pacific). Joining the fray are Lotteria (195 outlets by Lotte Group), Jollibee (60 outlets by Jollibee Foods Corp), Pizza Hut (54 outlets by Yum! Brands Inc and Jardine Pacific), Domino’s Pizza (24 outlets), Popeyes (16 outlets ), Burger King (13 outlets by Imex Pan Pacific), McDonald’s (8 outlets by Good Day Hospitality), Subway (6 outlets) and Carl’s Jr (3 outlets).

Al Frescos Group has 31 outlets across 7 brands today including; Al Frescos (11 outlets), Pepperonis (13 outlets) and Jaspas (3 outlets). L Concepts (The Longfort Group, Malaysia) plans to open the Sizzlin’ Steak chain one of many casual dining brands from the Manila based Max Group Inc.’s. Following their acquisition of L’Usine in 2015, yet another high end cafe and casual dining environment will be expanding sites.

Even ice cream joins the rise of branded chains with Baskin Robbins (24 outlets), Bud’s Ice Cream (20 outlets),Swensen’s (7 outlets) and Haagen-Dazs (2 outlets) with more to come as TNC Holdings are launching Cold Stone Creamery in Vietnam in 2016. Chain bakeries have emerged with Fresh Garden (32 outlets), Dunkin Donuts (16 outlets), BreadTalk (15 outlets) and Tours les Jours (12 outlets).

The rise of modern chains has changed the shape of Vietnam’s retail environment and the rental market. They are set to continue to rise with property development and increased interest from private equity groups.

Health consciousness in Vietnam translates into action and spend

The fifth of the Vietnam consumer market trends 2016 is increased health consciousness and spend. In 2005 consumers in Vietnam ranked health as a top concern (behind their job and the economy). It remains the same in 2015. However in these health concerns had superficial misguided consumer reactions, for example consuming cleansing and detoxifying beverages such as 0 Degrees (an inner cooling and purification positioned beverage from THP) launched in 2006, which in fact contained very little green team and is mostly sugared water.

Fast forward to 2015 and as Cimigo noted in the Consumer healthcare trends in Vietnam, Asia report the use of traditional remedies and supplements as exploded. Vietnam is seeing exponential growth in health supplements and healthcare spend, consider that outbound overseas medical tourism reached US$2 billion spend by consumers from Vietnam in 2015.

Food safety concerns have only increased over 2005 and remain very topical today, leading to new investments to address consumer fears. VinGroup’s Vineco has invested US$44 million in hygienic fresh vegetable production to supply its own Vinmart mini markets with fresh safe local produce.

Branded chains in gyms, health and beauty retail and pharmacies emerging in Vietnam

Branded chains are emerging with over 100 branded gyms now available to capture value from these healthy lifestyles. Beauty and healthcare chains are on the rise with GNC (11 outlets), Medicare (41 outlets) and Guardian (37 outlets) amongst those expanding. Pharmaceutical retail has reacted with a largely disorganised sector becoming gradually organised with the rise of chains (several of whom are vertically integrated) such as Phano (51 outlets), Pharmacity (31 outlets), My Chau (7 outlets), Indochina -Dong Duong (5 outlets) and Eco (2 outlets). Healthcare is one category growing strongly for e-commerce with sites such as Pharmacy Supermarket.

Conspicuous consumption has always been mobile in Vietnam

The sixth of the Vietnam consumer market trends 2016 is in status driven conspicuous consumption. In 2005 conspicuous consumption was most obvious and mobile in the motorbike that one drove. In 2005 The Gioi Di Dong (Mobile World) opened their fourth store, today they have 600 stores. Other mobile phone retail chains include FPT (290 outlets), Viettel (285 outlets) and Viet Thong A (193 outlets). The replacement cycle has shortened dramatically as mobile phones become the new signal for social status.

Keeping up with the Nguyen’s with consumer finance in Vietnam

The seventh of the Vietnam consumer market trends 2016 is the rise of consumer finance for consumers in Vietnam. In 2005, 6,000 new apartments sold in Vietnam according to CBRE. In 2015, 36,000 new apartments were sold. In 2005 just over 25,000 new passenger cars were sold, in 2015 just over 125,000 new passenger cars were sold. Consumer finance in Vietnam reached 3.6% of GDP in 2005 at US$1.6 billion in consumer loans, in 2015 it is an estimated 9% of GDP at US$16 billion.

Consumer finance companies with their quick approval processes for unsecured loans have fueled the growth in consumer financing. Home & improvements account for approximately 40%, home appliances and electronics 30% and motorbikes and cars 15%. Look at a new apartment, a motorbike showroom or browse a mobile phone or home appliances store and there will always be several competing consumer finance agents, ready to sign up the consumer in Vietnam with financing. Keeping up with the Nguyen’s is made far easier with this easy access to unsecured consumer finance.

Self expression immediacy in Vietnam

The eighth of the Vietnam consumer market trends 2016 is the rise of social networks for self expression. In 2005 self expression was strongest on the now defunct Yahoo blogs, singing ballads at karaoke and football mania to rival the best British football fan. In 2015, as this previous post noted on Online, mobile, social media in Vietnam Asia the growth in internet, social media and instant messaging applications is enabling 35 million consumers in Vietnam to post emoticons, stickers, selfies and status updates.

Mobile drives internet penetration and habits in Vietnam

The ninth of the Vietnam consumer market trends 2016 is the changes in media consumption as mobile drives internet penetration and mobile, video and over the top TV streaming converge.

Nationally 48% of the population is accessing the internet in 2015. Frequent online access (in the past 7 days) is far higher in urban areas having reached 72% by December 2015. In contrast many rural consumers remain without online access or access infrequently, only 20% are regularly accessing the internet. Mobile penetration is increasing access for rural consumers as rural penetration of mobile smartphones increases.

Mobile phone penetration including smartphones has reached 69% nationally amongst those aged 15 years or more. Smartphone (included within the latter statistic) penetration has reached 28% of those aged 15 years or more. Mobile access to the internet is changing the habits amongst online consumers in Vietnam and is successfully increasing penetration for two key consumer groups; consumers in rural areas and consumers aged over 35 years. For many consumers in Vietnam their first online experience is via mobile, having leapfrogged other devices.

Online mobile page views are growing exponentially and as at the end of 2015 accounted for 1 in 4 page views. The implication for brands and their digital marketing teams are discussed in more detail here Online, mobile, social media in Vietnam Asia. Further evidence of the rise on smartphones is found in the growth of mobile app downloads which grew by 60% in 2015.

Fragmented opportunities as mobile, video and OTT TV converge in Vietnam

Mobile audiences for video streaming are growing exponentially. The convergence of video and mobile, which when married with local media content and efficient streaming, will reap huge rewards. The next technology race for active users of mobile native applications in Vietnam will be the streaming of online video to mobile smartphones.

Experience in China demonstrates the massive revenue opportunity waiting to be grabbed for the winner of this battle. Digital brand marketing teams in Vietnam will have to brace themselves for the winners of the real estate battle for chatting and video streaming native applications. Social media promotion in Vietnam remains inexpensive. New dominant players in chatting and video mobile applications will be the omnipresent media channels to directly communicate with consumers. Soon the winners will be start to monetise and generate significant revenue from brands to access these consumers.

Watch out for Clip which has an abundance of local video on demand content and is closest you can come to a local YouTube in Vietnam. Other over the top (OTT) channels to watch include established telecommunications firms FPTplay (FPT), NetTV (Viettel) MyTV (VNPT) and new entrants Fim+ and Netflix, which may be limited by a focus on Hollywood content.

Consumers in Vietnam shift from brand ownership to new experiences

The tenth of the Vietnam consumer market trends 2016 is the shift in consumer fulfillment from the ownership of brands to new experiences; particularly experiences which can be socially validated and shared to provide a sense of actualisation. In 2005 consumers in Vietnam were bombarded with new consumer packaged brands. Opportunities to use these new brands gave consumers a sense of fulfillment; of catching up with the consumer world seen overseas on TV.

Today the urban and more affluent consumer in Vietnam finds fulfillment and a sense of accomplishment through their shared experiences. That may be trying the new retail environments discussed herein, enjoying a gym membership, rock wall climbing, experiencing the delights of modern cinema or travelling independently.

Leisure travel and tourism habits provide a great example of this shift. In 2005 a traveller in Vietnam was likely to travel domestically in groups and the lucky few who travelled overseas would typically do so on tour group packages. As Cimigo’s Insights to Travellers report indicates, travel habits have changed dramatically with many urban consumers having experienced international leisure travel, where independent travel accounts for nearly half of these travellers’ experiences.

Garnering involvement and excitement with new packaged brand launches a has become far harder, as consumers shift purchase priorities to enjoying and sharing new experiences.

10 Vietnam consumer market trends 2016 impacting purchase priorities

1. High income households double in 10 years in Vietnam.

2. Life stages in Vietnam are maturing. Kids are less influential in determining purchase priorities.

3. The rise of new retail chasing share before profits in Vietnam.

4. The rise beer clubs, cafes and casual fast service restaurant chains grow in Vietnam.

5. Health consciousness in Vietnam translates into action and spend.

6. Conspicuous consumption has always been mobile in Vietnam.

7. Keeping up with the Nguyen’s with consumer finance in Vietnam.

8. Self expression immediacy in Vietnam.

9. Mobile drives internet penetration and habits in Vietnam.

10. Consumers in Vietnam shift from brand ownership to new experiences.

More hot consumer market research trends Vietnam Asia

Cimigo, a market research agency Vietnam, Asia presents the latest consumer trends.

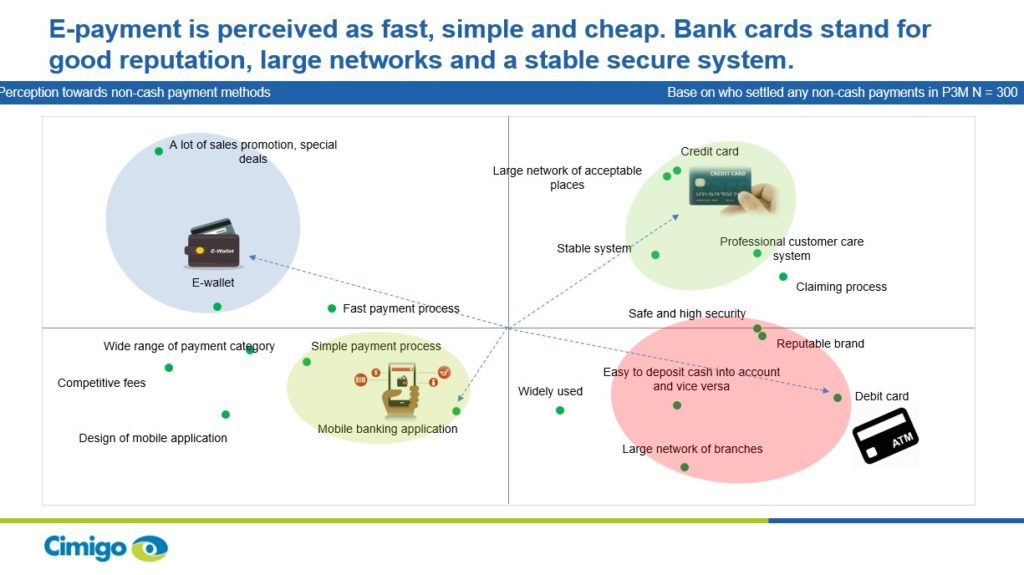

A diverse set of international and local competitors from Apple, Facebook, Visa, GoViet, Bao Viet and VIMO will join the battle and seek to win dominance in mobile enabled e-payments. The battle will be long and the investments losses substantial. Much like Vietnam’s online shopping platforms, until a dominant player can comfortably increase fees and cease to subsidise transactions, the only winner will be the consumer.

A diverse set of international and local competitors from Apple, Facebook, Visa, GoViet, Bao Viet and VIMO will join the battle and seek to win dominance in mobile enabled e-payments. The battle will be long and the investments losses substantial. Much like Vietnam’s online shopping platforms, until a dominant player can comfortably increase fees and cease to subsidise transactions, the only winner will be the consumer.